Come January it is not uncommon to start worrying about, or even dreading, Year End. But don't worry, we have got your back.

We understand that lack of time at Year End is a real issue for Clerks and RFO's, and you might find yourself working more hours than contracted.

Let's put Year End on the back burner for the moment, and think about the cashbook. Ensuring your cashbook is up to date and in good order sets you in good stead for 31st March. By spreading the workload during January to March, you can mitigate those overtime hours and stress.

So what can you be doing now, that your future self will thank you for? Read on to find out...

🔢 Data Ready?

Thinking about your cashbook, it's import that you are up to date in terms of transactions entered. If you are a couple of months behind try, and set aside a few hours throughout the week to get your transactions entered to date. The time needed will depend on how far behind you are, and the number of transactions that need entering, so take this into consideration when booking time into your calendar.

You should also check the accuracy of your transactions, ensuring they have been allocated to the correct budget heading VAT rate. Corresponding paperwork can help with this, such as invoices and receipts, and will help when you get to the internal audit.

✅ Reconcile, Reconcile, Reconcile

Did I say reconcile? You won’t believe how many Parish and Town Councils reconcile their bank accounts once a year, and just before Year End! I do not recommend doing this as it can be very time consuming having to trawl through 12 months of emails, documents and correspondence to investigate a discrepancy in your records. Get into the habit of reconciling every month, even if it's only a handful of transactions.

Ensure your last bank reconciliation is balancing before moving on to the following month. This means if you do discover a discrepancy, you only have one month of data to look back on. Continue until you are up to date - you will be thankful you have done it and it will save you time later on, when you really need it!

🪙 VAT

Now is also the time to ensure your VAT records are up to date.

If you're VAT registered, you will be governed by your VAT dates as to when you need to submit a return.

If you're not VAT registered, and therefore just claiming VAT back, there is no specific timeframe in which you need to do this. We therefore recommend doing this annually and ideally in line with the financial year (1st Apr - 31st Mar).

This is where checking corresponding documents comes in handy, as you will need a valid VAT invoice with the suppliers VAT number in order to claim VAT back.

💻 Free Training

Year End doesn't have to be a total nightmare! Register for our free training sessions for more top tips and advice to guide you through Year End and the lead up to it.

🔓 The Secret to Mastering Year End for Town & Parish Councils

Hannah Driver, Senior Accountant, Scribe

Wednesday 31st January, 11am - 12pm - REGISTER HERE

Thursday 29th February, 1pm - 2pm - REGISTER HERE

Wednesday 20th March, 11am - 12pm - REGISTER HERE

🏆 Navigating the Path to a Successful Internal Audit

Tim Light, Chairman and Convenor of the Internal Audit Forum

Monday 19th February, 1pm - 2pm - REGISTER HERE

🧘🏽 Hello to spare time

If you really want to save some time, and lots of stress, then join Scribe. Our dedicated accounts software, purpose-built for Parish and Town Councils.

You can use Scribe to

- Produce your Annual Return

- Claim VAT back or submit VAT returns

- Reconcile and report on bank accounts

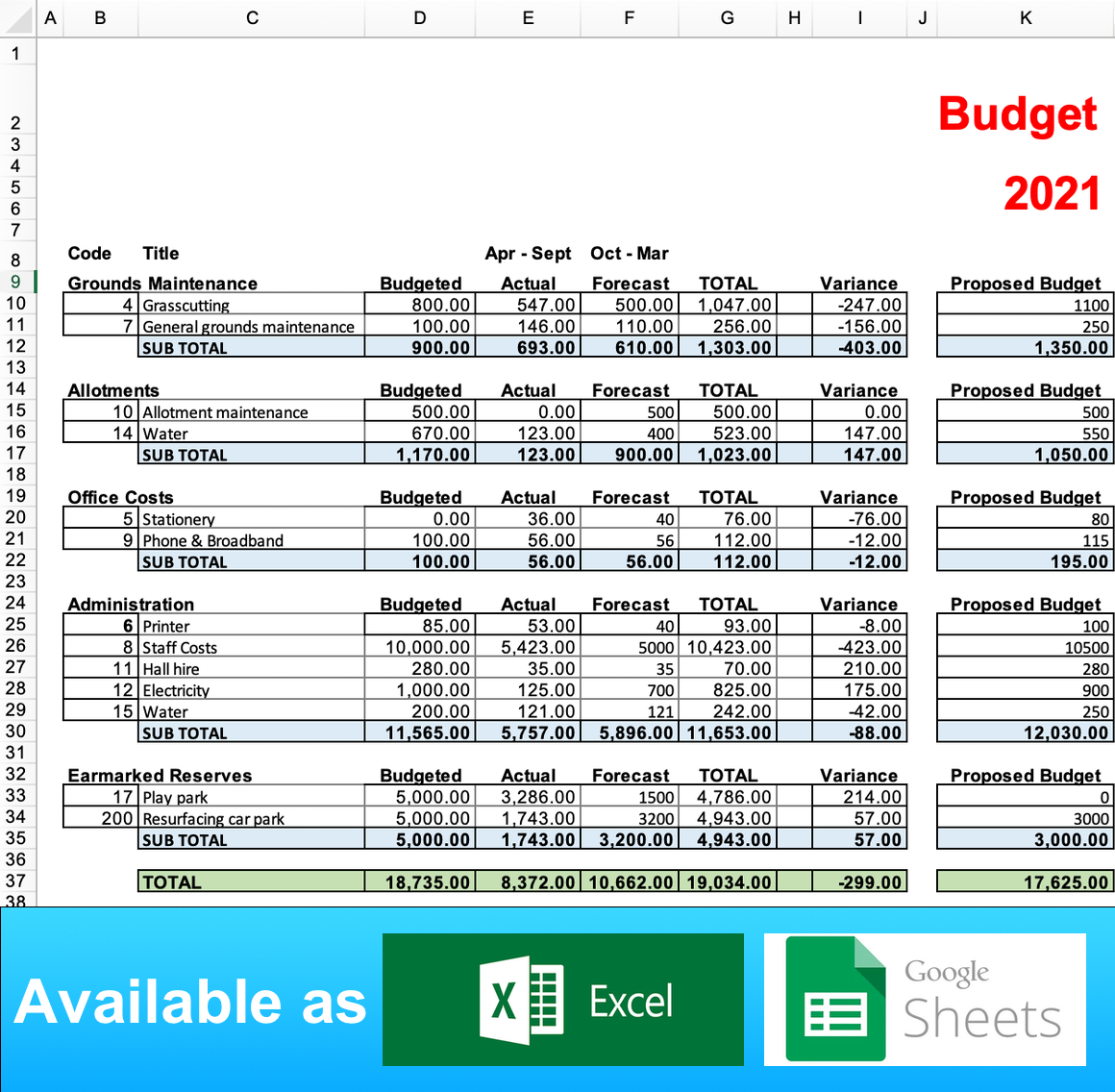

- Manage and report on budgets

- Save time and wow councillors with its many reports that can be produced in just a click of a button.

We have a team of qualified and part qualified accountants, a CiLCA clerk, expert trainers and problem solvers. All our calls, emails and messages are responded to within minutes.

Like the sound of Scribe. To find out more visit www.scribeaccounts.com

.png)